Library picture: Rolex Daytona Tropical

An insurance company has refused to pay out on a lost 1976 Rolex Daytona Tropical watch said to be worth £190,000.

Mayfair gallery art dealer Christopher Jones, 26, lost the timepiece while skiing.

But his claim was denied because he did not mention an earlier claim for a missing diamond.

Insurer Zurich cancelled the £4,250 policy when investigators found out about the £15,000 claim for the gem.

Zurich said it would never have agreed to cover Mr Jones’ high-value watch if it had known about the diamond.

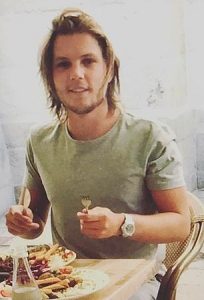

Picture: Christopher Jones Instagram

Mr Jones took legal action against the insurer.

But after a three-day High Court hearing in London his case has been dismissed.

Mr Jones, 31, lost his Rolex Daytona at the Rocky Mountains resort in Aspen, Colorado, in March 2019.

He blamed “human error” for misleading the insurer.

The court was told the policy had been arranged by his uncle, Thomas Trautmann.

When pricing it up Zurich asked if any claims had been made in the previous five years.

The missing diamond pay out in 2016 was not declared.

Mr Jones had earlier said his uncle was unaware of the lost diamond.

However, he later admitted that not only did his uncle know – but he had even helped put in the claim for the diamond.

Judge Pelling, in his judgment, raised concerns about the Mr Jones’ credibility.

He highlighted several inaccuracies in his evidence that, he said, showed “at the very least a fairly fundamental lack of recall of critical events”.

Mr Trautmann said he “probably should have” declared the 2016 claim.

He said: “My father was very ill, I had other things on my mind.

“I wasn’t just working for Christopher – I was working for three directors.”

Zurich’s senior underwriter Michael Green said he would have refused to insure Mr Jones’ watches had they known about the missing diamond claim.

Judge Pelling said:

“Zurich is entitled to avoid the policy and refuse the claim but must return the premium paid.”

After the case Zurich said:

“When customers apply for insurance, it’s essential they provide an accurate account of the information we ask for.

“This enables us to decide if we can provide cover, at what level and the price.”