Brussels is bracing for a fresh confrontation over “sin taxes”, as Europe’s nicotine, alcohol and processed-food sectors mobilise behind the scenes in response to upcoming EU reforms that could reshape consumption, public health strategy and member state revenue.

The Battle Lines Are Drawn

Industries producing tobacco, alcohol, and foods high in sugar or salt, collectively termed “sin industries” in policy literature, are intensifying their engagement with European Union policymakers as the Commission advances a new framework of fiscal and public health interventions.

Fuelled by pressure to improve population health, reduce long-term healthcare costs and explore new EU-level revenue sources, the European Commission is reconsidering how these goods should be taxed. This has triggered what insiders describe as “an undeclared war” among industries concerned about how heavily they will be targeted and who will bear the fiscal and reputational cost.

Taxation of tobacco, alcohol, and sugar-containing products represents a policy instrument designed to discourage consumption and advance public health objectives. The theoretical foundation of such taxation rests on the principle of negative externalities: the consumption of these goods generates social costs, including elevated healthcare expenditures, diminished labour productivity, and environmental degradation, that are not reflected in market equilibrium prices. By increasing taxes and consequently raising prices, the financial responsibility for these societal costs is passed on to consumers.

Tobacco Tax Reform Stuck in Neutral

Tobacco taxation is traditionally the most advanced and harmonised area of EU excise policy. Yet reform has stalled. Member states disagree over minimum rates, how to classify newer nicotine products, and whether more aggressive price signals would push smokers towards black markets.

Commission experts have openly acknowledged that “we are nowhere” on delivering a unified overhaul. Countries reliant on tobacco excise for national budgets remain cautious, while public health actors argue that stronger measures are essential to achieving Europe’s smoke-free goals.

The stalemate has given the tobacco industry more room to lobby discreetly for a slower pace of change, highlighting fears of smuggling, rising consumer prices and impacts on low-income groups.

Alcohol Producers Warn of ‘Unfair Burdens’

Alcohol manufacturers are also on edge. While most EU countries apply excise duties to spirits, wine and beer, rates differ widely, and health-driven calls for harmonisation are growing louder. Industry groups insist that further taxes would disproportionately harm small producers, distort competition and undermine Europe’s €360 billion wine and spirits economy.

They argue that the sector is already heavily regulated, and that blanket health taxes risk treating all alcohol consumption – including moderate use – as inherently harmful.

Nonetheless, health NGOs and several member states favour tougher EU-level measures, citing rising rates of alcohol-related disease and the significant burden on public healthcare systems.

Processed Food Sector: The New Frontline

The most contentious emerging issue is whether processed foods high in sugar, salt or saturated fat should be brought under the same “sin tax” (or health levy) framework traditionally applied to alcohol and tobacco.

This would represent a major shift in EU regulatory thinking.

Manufacturers of soft drinks, confectionery and packaged foods fear becoming the next target of public-health-driven taxation. Some member states have already introduced national sugar taxes, but Brussels is now exploring whether bloc-wide measures could support health objectives and contribute new “own resources” to the EU budget.

Industry groups are lobbying to shape definitions and thresholds – arguing that nutrient profiling is complex, that reformulation efforts should be rewarded, and that a sweeping “junk food tax” would unfairly penalise both producers and consumers.

Major food and beverage industry actors have articulated substantive critiques of the European Union’s proposed excise taxation framework targeting products deemed detrimental to public health. They contend that the policy lacks adequate scientific rigor, specifically citing insufficient product differentiation and failure to account for contextual variations in consumption patterns.

A Clash of Narratives: Health vs. Economics

At the heart of the battle are two competing narratives:

The Public Health Narrative

- Taxes on harmful products help reduce consumption.

- Healthcare systems bear the long-term cost of unhealthy lifestyles.

- EU-wide harmonisation would eliminate loopholes and strengthen consumer protection.

The Industry and Economic Narrative

- Higher taxes fuel illicit trade and cross-border shopping.

- “Sin taxes” disproportionately hit lower-income consumers.

- New levies risk damaging established manufacturing industries and jobs.

- Member states should retain sovereignty over politically sensitive tax policy.

These competing pressures make the coming cycle of EU policymaking unusually unpredictable.

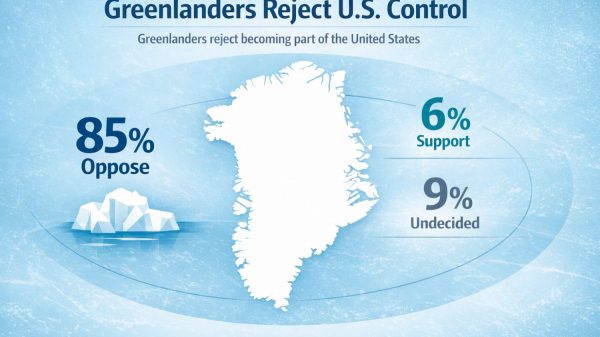

Member States Divided

National governments are far from united. Some, particularly in Northern and Western Europe, favour tougher action on tobacco, alcohol and unhealthy foods. Others are more hesitant, stressing economic competitiveness and the risk of political backlash from consumers and industry.

The absence of consensus suggests that proposed taxation reforms may encounter protracted deliberations within the Council, where fiscal policy decisions require unanimous approval. Industry stakeholders have expressed concerns regarding the potential adverse economic impacts of elevated excise duties on tobacco, food, and beverage sectors, particularly for companies whose product portfolios fall within the scope of the proposed regulatory framework. Industry representatives contend that such taxation measures may result in increased consumer prices and erode competitiveness in both domestic and international markets.

Industry associations advocate for evidence-based policymaking, asserting that comprehensive impact assessments must precede the implementation of broad-based health taxation schemes. These stakeholders argue for a multi-dimensional policy approach, wherein fiscal instruments are integrated with complementary interventions, including public health education campaigns and product reformulation initiatives, rather than deployed as standalone mechanisms.

With health, taxation and EU budgetary needs colliding, the 2026 legislative cycle could redefine how Europe regulates harmful or unhealthy products. For now, the only certainty is that Brussels’ “sin tax” debate is entering one of its most contentious phases in years.