Volga-Dnepr, once Russia’s leading air cargo operator, may soon be under new ownership as Evgeny Solodilin — an aviation executive with extensive international management experience — positions himself not merely as a buyer, but as a crisis manager seeking to rescue the struggling group. He previously headed Zhukovsky Airport and Red Wings Airlines, roles that add domestic depth to his international track record.

A Rescue Mission Rather than a Mere Takeover

Evgeny Solodilin, through his company is negotiating to acquire the entirety of Volga-Dnepr. The deal, confirmed by both sides, would include all three of the group’s airlines — Volga-Dnepr, Atran and AirBridgeCargo (ABC) — as well as its engineering and maintenance subsidiaries. No purchase price has yet been disclosed. Crucially, Solodilin is framing the transaction not as a transfer of ownership but as an attempt to stabilise and preserve a real business that has been battered by sanctions and debt.

A Strategic Turnaround Plan

Following an internal audit, Solodilin has drawn up a detailed debt restructuring strategy. Volga-Dnepr is estimated to owe around $500 million to lessors, while its grounded fleet could be worth as much as $1 billion. Central to his plan is the return of nine Boeing 747-8 aircraft from ABC’s fleet to foreign lessors, an approach that will require negotiations with Russian state authorities to obtain the necessary approvals. At the same time, efforts are underway to bring back aircraft detained abroad — including three An-124s held in Leipzig and a Boeing 737-800 in Cologne. The group also intends to restore several of its Boeings to service and potentially add Russian-built Il-96s, Tu-204s and Tu-214s to its fleet.

From Global Leader to Sanction Casualty

Until 2022, Volga-Dnepr was one of the world’s largest operators of heavy and outsized cargo. Western sanctions, however, grounded most of its international fleet. Of 11 An-124s, only three remain airworthy; ABC’s 14 Boeings are in storage; and Atran now operates just two An-12s.

The group’s founder, Alexey Isaikin, recently offered to hand the company over to the Russian state to avoid bankruptcy. But the Ministry of Transport rejected the proposal, arguing that state participation would undermine Moscow’s anti-sanctions strategy.

Prospects for Recovery

Industry observers believe Solodilin’s background in international aviation partnerships could prove decisive in resolving disputes with foreign lessors and unlocking detained assets. During his leadership at Zhukovsky, he worked with Lithuania’s Avia Solutions Group, Azerbaijan’s SilkWay Holding, and Munich Airport’s operator on joint ventures. This track record is seen as critical in building trust with overseas partners and creditors.

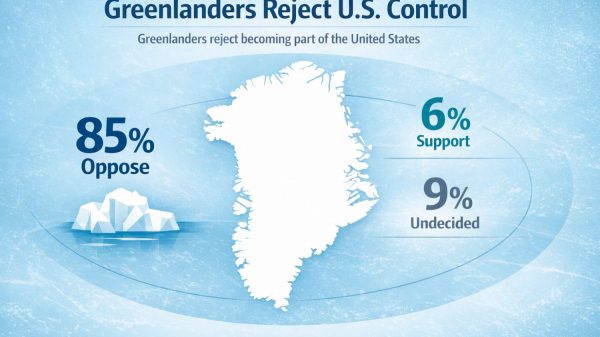

If successful, the acquisition could preserve around 1,500 jobs. Sources also suggest that revenues may be supported by renewed cargo flows, particularly through the restoration of routes linking Russia with China and EAEU countries. With Chinese airlines now commanding 93% of the Russia–China cargo market — up from less than 40% before 2022 — reclaiming commercial rights already held by ABC could provide real opportunities for growth.

Market Challenges Ahead

Experts caution, however, that Russia currently has no viable domestic market for Boeing 747 freighters. Maintenance limitations and fierce competition from Chinese carriers remain key obstacles. Analysts stress the need for a new, sustainable business model, noting that Volga-Dnepr’s previous global operations relied on international “round-the-world” networks that are no longer viable under sanctions.

Still, if EAS Group succeeds in restructuring debts, securing state approval for aircraft transfers, and reactivating its fleet, some believe Volga-Dnepr could chart a path to recovery. As one analyst noted, “Returning aircraft to operations or owners is a crucial step in restoring viability — but building a profitable new model for Russia’s changed market will be the real test.”